CLOSE

About Elements

TANAKA is a leading company in the field of precious metals.

Advanced materials and solutions that support societal progress, the development stories behind them, the voices of engineers, and our management philosophy and vision—

Elements is an online media platform that shares insights that lead to a better society and a more prosperous future for the planet under the slogan “Mastering Precious Metals.”

Evolution of power semiconductors supporting GX promotion and the spread of EVs: A closer look at the current state of the material development supporting its foundation

Major roles of power semiconductors: power supply control and motor control

Major roles of power semiconductors: power supply control and motor control Power semiconductors reduce power consumption due to the spread of generative AI

Power semiconductors reduce power consumption due to the spread of generative AI Next-generation power semiconductors using “SiC” and “GaN”

Next-generation power semiconductors using “SiC” and “GaN” Expectations for the U.S., China, and India

Expectations for the U.S., China, and India TANAKA Precious Metals maximizes the potential of precious metal materials

TANAKA Precious Metals maximizes the potential of precious metal materials

Expectations for the U.S., China, and India

Abe: Japan has long been a leader in power semiconductor research and development, but now Europe, the U.S., China, and other countries are also putting efforts into this field. Could you tell us about industry trends in countries around the world?

Minamikawa: China is determined to hold global dominance in the realm of EV. China has the highest number of xEVs, including EVs, HVs, and PHEV, in the world, with nearly 40% of new vehicles being xEVs. Japan also has a high percentage of xEVs at about 30%, while Europe and the U.S. have about 20%.

So, China uses a lot of power semiconductors, and the whole country is working hard on its development.

Abe: Do you think technological development and manufacturing locations are linked to the trends of a country as a place of demand?

Minamikawa: Until four or five years ago, semiconductors were becoming globalized, and a supply chain was in place to manufacture them in the most suitable locations, such as places where the costs were low or where there were many engineers.

That has changed dramatically over the past three years. Semiconductors are the most important technology in terms of economic security, and as they say with decoupling, they stem the flow of technology. The U.S., for example, has very strict regulations against China.

Abe: Is the expectation that the U.S. regulations will be maintained for the foreseeable future?

Minamikawa: It will probably last for a long time. Last December, there was a bipartisan report from the U.S. Congress titled “Reset, Prevent, Build.” It is a consensus that will not change even if the administration changes.

“Reset” refers to rethinking the U.S. economic relationship with China. “Prevent” means stemming the flow of the U.S. technology fueling China. “Build” is about the need to launch a new market to replace the shrinking business with China—that is, with the Global South, India.

Abe: I see. What are your thoughts on the growing expectations for India?

Minamikawa: Ultimately, I believe that things are starting to move forward in earnest. This is largely due to the fact that the U.S. approach will be a major driving force and support, and also that the Indian government has decided to provide subsidies of up to two to three trillion yen in the future.

However, it takes time. It took nearly 20 years for China’s semiconductor industry to grow to this level. So, it will take 10 to 15 years at best to get there.

Abe: Compared to the past, will the subsidy amount from the Indian Government this time have a huge impact?

Minamikawa: Yes, it will. In the past, the subsidies ranged from a few tens of billions of yen to 100 or 200 billion yen. This time, it will be two to three trillion yen, so the scale is completely different. New semiconductor clusters are also now being developed and said to be in full swing.

This is good timing because China’s population is not growing, and its economy is slowing down. China has been one of the world’s major growth engines, but now that it has weakened a bit, the world is looking for its next engine.

Abe: So, you see India not only as a production site but also as a place of demand?

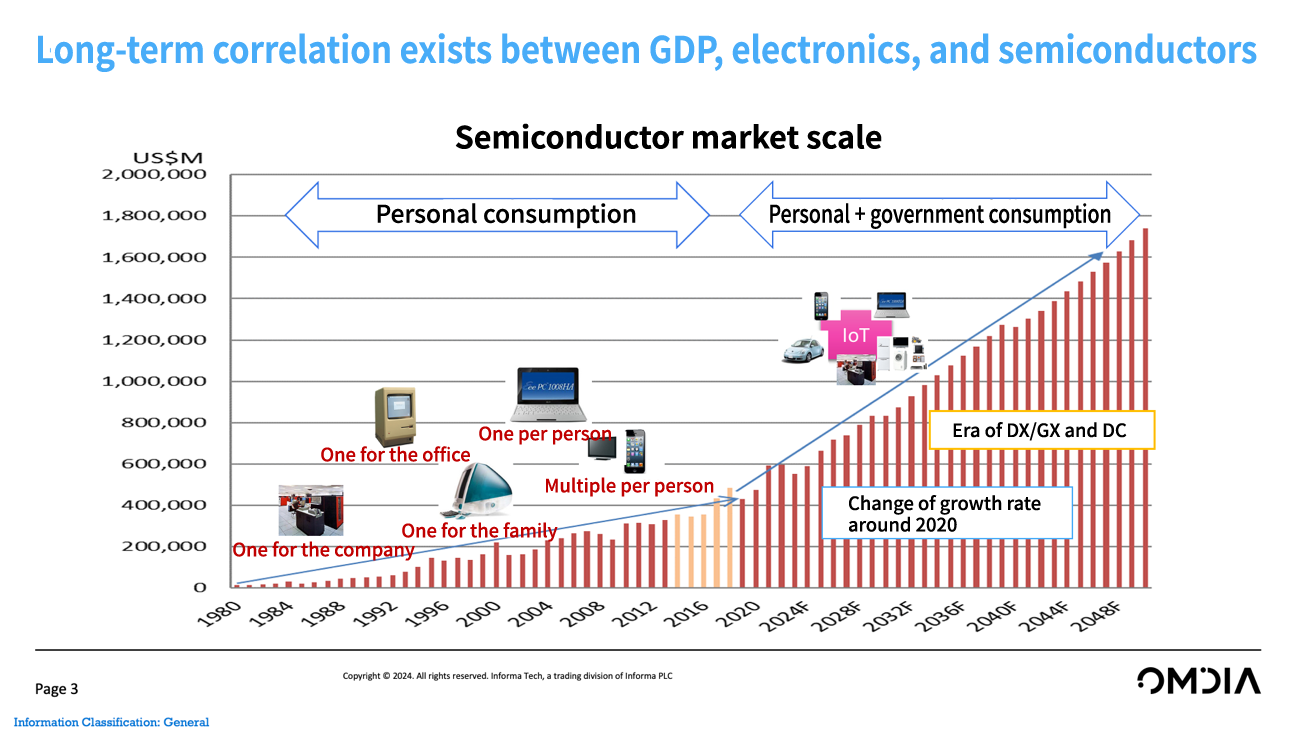

Minamikawa: Population and world GDP are highly correlated in the growth of electronic industry.

As the population increases, GDP increases. As GDP increases, consumption increases. Personal consumption accounts for approximately 50% of the world’s GDP. Demand for semiconductors will grow as individuals buy PCs, smartphones, and home appliances.

In addition, demand will grow in the areas of DX (Digital Transformation) and GX (Green Transformation). This is not on an individual issue. It is a matter of where investments are made in national policies, which is closely related to infrastructure.

I believe this means a growth driver will emerge in the form of government consumption, rather than just personal consumption, which has been the case until now.

We expect the pace of the market scale expansion to accelerate in the late 2020s, and power consumption will increase dramatically from this point onward. This is due to AI. Therefore, materials are important to power consumption.

Abe: The next materials will be absolutely necessary.

The phase toward mass production has already started for SiC, and although I think the mass production of GaN will take a bit more time, I am sure that the trend will continue in the medium term.

next page TANAKA Precious Metals maximizes…

Related Information

Technology Trend and Advanced Packaging Material for Power Device

Power device is key component for a wide range of applications such as smartphones, electronic devices, next-generation mobility including EV and HEV, cellular base stations, power control for renewable energy and so on. Its technology development is thriving day by day.

We introduce advanced packaging technology trends and cutting-edge materials designed to address challenges such as high heat dissipation, high heat resistance, reliable bonding in manufacturing, and miniaturization.

![]()